Travel And Flight Insurance

Travel and flight insurance policies offer;another type of coverage that may;require you to pay a premium for insurance that could overlap;with coverage;or benefits you already have. Before you spend money on travel insurance, check your current health and life policies to see how accidents or injuries during travel or flights are covered. And in the event of a catastrophe, your life insurance policy should cover you if you pass away while traveling.;

If you use a to book tickets or travel arrangements, you’ll also want to check with your credit card company to see if any travel protections are included with your account. Many credit card companies automatically provide benefits like car rental insurance, lost baggage insurance or travel accident insurance as part of your cardmember agreement. The caveat is that you’ll need to book your relevant travel expenses using the card for those coverage protections to kick in.

And you find that you still need some additional insurance to keep your mind at peace, you can always purchase a small travel policy to cover the gaps in your existing coverage.

Best For Ease Of Qualifications: Breeze

Breeze

Why we chose it: Apply online and receive a decision in minutes with this company that is upfront about their needed qualifications.;

-

Can apply online and receive a response in minutes

-

Lump-sum cash benefit for cancer, heart attack, stroke, or organ transplant

-

Not available in New York state

-

Coverage is for critical illness, which slightly raises the price

Breeze provides critical illness insurance for illnesses that include cancer. Their online application provides a quote and instant decision within minutes. To obtain a quote, you must provide a few details, including birthdate, zip code, and whether you are a smoker. You will then receive a quote where you can adjust the amount of desired coverage, ranging from $5,000 to $75,000. Once you do this, you can move forward with the application. Youll then answer several health history questions, such as if youve had a heart attack, stroke, or been diagnosed with cancer within the past five years.;;;

We were quoted a price of $20.70 per month for a 40-year old woman to receive $25,000 in benefits. To receive $50,000 in benefits, the monthly cost would be $39.22. While the price is more than some cancer insurance policies alone, the policy does cover multiple medical conditions.;

Breeze does not offer supplemental critical illness insurance in New York state.

What Is Cancer Insurance

Cancer insurance is a type of supplemental health insurance designed to help with unexpected expenses if you receive a cancer diagnosis. This financial support is typically used as a way to help with some of the medical costs that are not covered under your regular health insurance plan and may also assist with other expenses while you are receiving treatment, such as your mortgage and utilities.

You May Like: How Can You Get Skin Cancer

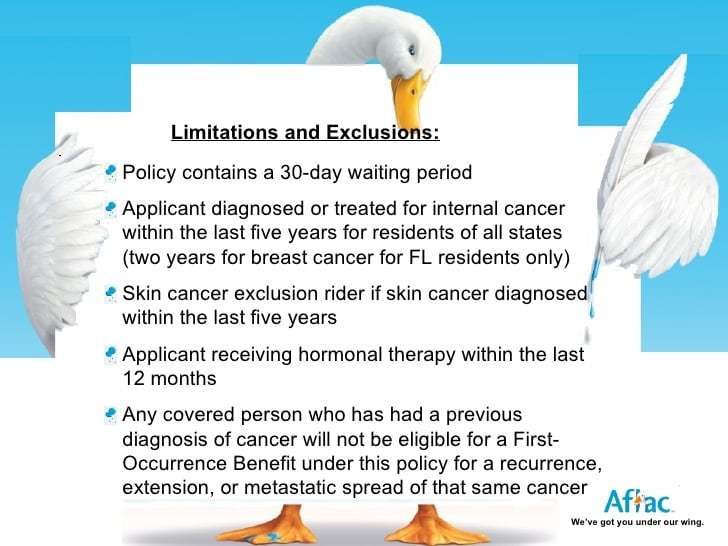

Limited Coverage Of Skin Cancers

Skin cancer is the most commonly diagnosed form of cancer. The primary categories of skin cancer are basal-cell carcinoma , squamous-cell carcinoma , and melanoma. The first two, collectively known as non-melanoma skin cancers , are highly unlikely to metastasize and comprise the majority of skin cancer diagnoses.

Many cancer insurance plans do not offer benefits for policyholders diagnosed with these non-melanoma skin cancers, or a large share of cases that are frequently called cancer. Other plans that provide both initial-diagnosis payments and recurring payments may not provide a lump-sum benefit for the initial diagnosis of a non-melanoma skin cancer.

What Is Covered Under Personal Accident Insurance

A Personal accidental insurance policy covers both minor and major accidents. Besides covering fatality, it covers total or partial disability. Also, it covers temporary disabilities, due to which you might be restricted from earning for a while. A basic coverage usually includes death and permanent total disability.

Also Check: How Does Immunotherapy Work For Melanoma

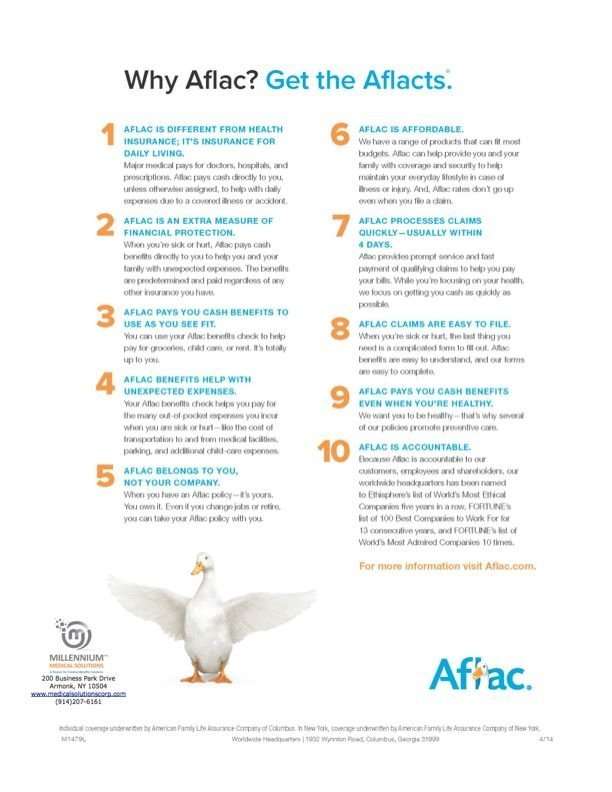

How Does An Aflac Cancer Insurance Policy Work

You never know what the future could hold, which is why its so important to help protect yourself with Aflac Cancer Protection Assurance. These plans dont just help with medical expenses. Rather, they pay you cash directly, unless assignedinstead of a doctor or hospitalto help you manage expenses like bills, rent, car payments, groceries, child care and more. Cancer is expensive, but with Aflac Cancer Protection Assurance, patients can focus on the most important thing: getting better.

Step 1 – You come down with a fever.

After frequent infections and a high fever, you decide to head to your physician to see whats the matter.

Step 2 – Time for some tests.

The physician recommends a bone marrow biopsy to check for cancer.

Step 3 – You receive your diagnosis.

The biopsy results are in, and unfortunately they show you have leukemia.

Step 4 – You begin treatment.

Aflac Cancer Protection Assurance helps with medical expenses like chemotherapy and with non-medical expenses like travel and lodging to help keep life as normal as possible for you and your family.

Insurance Can Be Extremely Important But It Can Also Be Unnecessary

There are undoubtedly some types of insurance that everyone;absolutely should have. Car insurance, health insurance and homeowner’s insurance are easily in the top three. Life insurance and long-term care insurance are also something you may want to consider as you shape your estate plan.

These types of insurance can help protect your health, life and property, while also providing financial reassurance for your loved ones. But there are some types of insurance that may be unnecessary for helping you to further your financial goals. As you assess your insurance needs, consider carefully whether to include these types of policies.

You May Like: How Long For Squamous Cell Carcinoma To Spread

Does Aflac Pay For Mammogram

MAMMOGRAPHYAflacpaymammographyAflacpay

People Also Asked, How much does aflac pay for a colonoscopy?

Similarly, it is asked, how much does Aflac pay for a colonoscopy?Aflac will pay $75 per calendar year when a charge is incurred for one of the following: breast ultrasound, biopsy, flexible sigmoidoscopy, hemocult stool specimen, chest X-ray, CEA , CA 125 , PSA , thermography, colonoscopy, or

Also know, what does my Aflac cancer policy cover?The plan pays a cash benefit upon initial diagnosis of a covered cancer, with a variety of other benefits payable throughout cancer treatment. The Aflac Cancer Care plan is here to help you and your family better cope financiallyand emotionallyif a positive diagnosis of cancer ever occurs.

Contents

Does Aflac Cover A Colonoscopy

Aflaccolonoscopy

Aflac has announced the launch of a new cancer protection program that does more to support prevention, early diagnosis and treatment. Aflac Cancer Protection Assurance offers coverage for screening tests and surgeries performed on the basis of genetic testing results.

One may also ask, how much will Aflac pay for a CT scan? AND IMAGING$150 Aflac will pay $150 per calendar year when a covered person requires one of the following exams and a charge is incurred: CT scan, MRI , EEG , thallium stress test, myelogram, angiogram, or arteriogram.

In this manner, how much does Aflac pay for a mammogram?

MAMMOGRAPHY AND PAP SMEAR BENEFIT: Aflac will pay $100 per calendar year when a charge is incurred for an annual screening by low-dose mammography for the presence of occult breast cancer, and Aflac will pay $30 per calendar year when a charge is incurred for a ThinPrep or an annual Pap smear.

How much does Aflac pay for gallbladder removal?

Surgical Benefit Aflac will pay $100$2,000 when a covered person has surgery performed for a covered sickness in a hospital or ambulatory surgical center based upon the Schedule of Operations in the policy.

Read Also: What Is Soft Tissue Carcinoma

What Is The Aflac Cancer Policy For The Insured

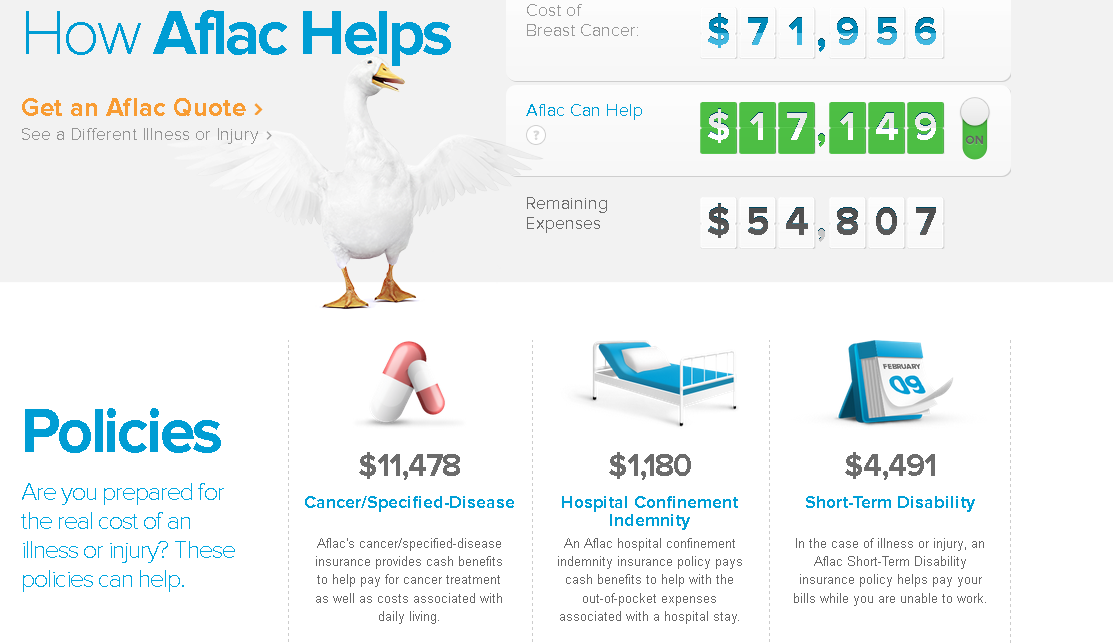

Aflac’s cancer/specified-disease insurance policy is a supplemental policy that provides policyholders with cash benefits for cancer-related expenses, explains the company. It is a policy designed to protect a policyholder from costs not covered in the individual’s main insurance policy.

The cancer/specified-disease insurance policy helps with costs related to out-of-pocket medical expenses, experimental cancer treatments, out-of-network specialists, child care, travel and lodging related to treatment, and other living expenses, notes Aflac. This policy is just one of many supplemental policies offered by Aflac to help individuals cover extra expenses not covered in their original policies. The lump-sum cancer insurance policy is another supplemental policy designed to provide policyholders with a pre-established amount of money for use in the event of a cancer diagnosis. Like the cancer/specified-disease policy, the lump-sum cancer policy covers medical treatments and everyday living expenses.

Aflac offers tools such as the real cost calculator to determine the costs of supplemental policies. Each cancer/specified-disease insurance policy differs depending on the age and gender of the applicant and the severity of the disease, reports Aflac. Additionally, state regulations and restrictions affect any details of a cancer insurance policy. Users can begin an insurance policy application online at the Aflac website or in person with an insurance specialist.

Best Overall: Mutual Of Omaha

Mutual_of_Omaha

-

Policies also cover heart attack and stroke

-

Pays 14 cash benefits, including preventative screening costs

-

Provides coverage for ages 18 to 89

-

Only offers lump sum policies for critical illness coverage

-

Products are not available in all states

Mutual of Omaha is well known in the insurance industry, having been in business since 1909. The Omaha, Nebraska-based company combines its cancer and critical illness coverage, so in addition to cancer coverage, you are also covered for illnesses such as heart attack or stroke.

Policies are available for people aged 18 to 89 and benefit amounts, which are paid in a lump sum, range from $10,000 to $100,000. The company offers policy terms of 10, 15, 20, and 30 years, along with a lifetime coverage policy. Policies also provide benefits for things like preventive screenings, hospice care, and ambulatory transportation.;

AM Best Rating: A+

Why We Chose It: When it comes to purchasing cancer insurance, we selected Mutual of Omaha as our best overall because it not only provides more coverage for the cost than some of the others, but it also provides things like preventive screenings, a selection of benefits ranges , and the ability to keep your policy until age 89.

You May Like: Is Melanoma Skin Cancer Curable

What Does Aflac Pay You For

Accident Emergency Treatment Benefit Aflac will pay $120 for the insured and the spouse, and $70 for children if a covered person receives treatment for injuries sustained in a covered accident. If the covered person is admitted directly to an intensive care unit, Aflac will pay $2,000.

You may ask, How much does Aflac pay for broken bone?

ACCIDENT SPECIFIC-SUM INJURIES BENEFITS: When a Covered Person receives treatment under the care of a Physician for Injuries sustained in a covered accident, Aflac will pay specified benefits ranging from $35 $12,500 for dislocations, burns, skin grafts, eye injuries, lacerations, fractures, concussion, emergency

How We Chose The Best Cancer Insurance Providers

We evaluated 15 insurance companies before choosing our list of the best. Some of the criteria we used to make our determination included length of time the company was in business, what each insurance company offered, and how it rated among its peers.

In addition, we looked at the ease of getting the information, such as policy cost, what is covered, and how each company treats pre-existing conditions and wait times. Finally, we looked at how easy it was to get our questions answered so that we could get you the information that we feel you need to know.

Also Check: How To Tell If Something Is Skin Cancer

Best For Customizable Coverage: Physicians Mutual

Physicians Mutual

Why we chose it: Physicians Mutual offers two benefit options and several riders that expand the policy to cover many critical illnesses or enhanced benefits.

-

Choose from two supplemental cancer insurance policies with different pay structures

-

Additional riders available to expand critical illness coverage

-

Quotes not available online

-

Riders available only to those younger than age 65

Physicians Mutual offers a cancer insurance policy that pays for a number of cancer-related costs. They offer two policy types that pay varying degrees for cancer costs, such as inpatient stays, surgery, treatments, and transportation. You can select from these two policies for the base benefits that most fit your budget and goals.;

If you desire, you can also further customize the policy by adding benefit riders of varying amounts. For example, Physicians Mutual has a First Diagnosis benefit rider, which offers a one-time payment of between $2,500 to $10,000 based upon your selection for the first diagnosis of “internal cancer,” according to the provider summary sheet. Because cancer costs are usually greatest in the first months after diagnosis, this rider may help when you need it most, according to the Cancer Action Network. These riders are available only to those under age 65.;

Physicians Mutual does not offer online quotes so you will need to contact an insurance agent to obtain premium information.

How Much Cancer Insurance Coverage Do You Need

The American Association for Critical Illness Insurance recommends that you buy enough cancer insurance to cover two years of mortgage payments. That said, your ideal coverage level depends on your illness, your financial security, your current insurance plan and your preferences.

For example, younger people pay a lot less than older people for cancer insurance coverage. This is because cancer rates are much lower when you’re younger. If you have an excellent healthcare plan, you won’t need as much cancer insurance coverage. Conversely, if you have a cheap plan with limited benefits, you might need a more extensive cancer insurance plan.

If you’re buying a lump-sum cancer plan, it should pay for more than just some of your medical care. The payout should also cover your daily expenses.

Ultimately, you should consult with an independent insurance agent about how much cancer insurance you need. Since they’re independent, they won’t try to sell you on one specific plan. We can connect you with a health insurance agent to simplify your search.

Don’t Miss: What Is The Main Cause Of Skin Cancer

Does Aflac Pay For Emergency Room Visits

Aflac will pay $100 when a covered person receives treatment for a covered sickness or accidental injury in a hospital emergency room, including triage, and a charge is incurred. The Hospital Emergency Room Benefit and the Hospital Short-Stay Benefit are not payable on the same day. No lifetime maximum.

Dont Rely On Cancer Insurance Alone

Before purchasing a cancer insurance plan, make sure your existing health insurance coverage is good enough. Cancer insurance is designed to supplement your primary health plan. If your primary health plan is poor, you’ll probably be better off buying better health insurance than adding cancer insurance.

Don’t Miss: What Happens If I Have Skin Cancer

Does Aflac Cover Thyroid Surgery

4.3/5AFLACcoveredsurgical operationcoveredsurgicalsurgery

ACCIDENT SPECIFIC-SUM INJURIES BENEFITS: When a Covered Person receives treatment under the care of a Physician for Accidental Injuries sustained in a covered accident, Aflac will pay specified benefits ranging from $35 $12,500 for dislocations, burns, skin grafts, eye injuries, lacerations, fractures, concussion,

Likewise, how much does Aflac pay for eye surgery? The Eye Examination Benefit now pays $45 for one eye examination per covered person, per policy year. Aflac Vision Now also offers coverage for serious eye conditions,5 including: Permanent Visual Impairment Benefit: $750$10,000 for visual impairment. Eye Surgeries Benefit: $50$1,500 for miscellaneous eye surgeries.

Also to know, how much does Aflac pay for pap smear?

MAMMOGRAPHY AND PAP SMEAR BENEFIT: Aflac will pay $100 per calendar year when a charge is incurred for an annual screening by low-dose mammography for the presence of occult breast cancer, and Aflac will pay $30 per calendar year when a charge is incurred for a ThinPrep or an annual Pap smear.

What does the Aflac Cancer policy cover?

The plan pays a cash benefit upon initial diagnosis of a covered cancer, with a variety of other benefits payable throughout cancer treatment. The Aflac Cancer Care plan is here to help you and your family better cope financiallyand emotionallyif a positive diagnosis of cancer ever occurs.

Aflac Cancer Protection Assurance

Policy Series B70000

In 2018, an estimated 1,735,350 new cases of cancer will be diagnosed in the United States.1

You’d expect your insurance company to cover your medical expenses in the event of a cancer diagnosis. Yet most major medical plans are designed to cover 70% – 80% of the costs, potentially leaving you with $24,000 – $36,000 in out of pocket expenses.2

That’s where Aflac supplemental insurance comes in. We pay cash benefits directly to you , so you can use anyway you see fit. We want you to be able to focus on your recovery, not your finances.

Recommended Reading: What Type Of Skin Cancer Is Deadly

What Does Cancer Insurance Cover

While coverage amounts vary, most cancer insurance policies pay for the following:

- Doctor visits.

- Blood transfusions.

- Ambulance rides.

More expensive cancer insurance plans may pay for additional benefits like outpatient treatment as well. These plans also tend to feature better waiting periods and coverage limits.

Lump-sum cancer insurance plans are more flexible. Most don’t restrict how you can spend the resulting funds. You can spend it on mortgage payments, housing, groceries pretty much anything.

Best Budget: Mutual Of Omaha

Mutual of Omaha

Why we chose it: Online quote tool lets you estimate policy costs and monthly premiums were some of the lowest we reviewed.

-

Many monthly premiums were less than $10 for individuals

-

Offers yearly amount for screening tests or vaccines

-

Some aspects of coverage are difficult to understand

-

Not available in all states

Mutual of Omaha offers supplemental cancer insurance with online quotes and the ability to apply for the policy online. For a 40-year old woman, we were quoted a price of $9.97 per month. Both individual and family policies are available through the company. You can also choose to add protections against heart attack and stroke.;

Besides its price, there are several unique aspects to the Mutual of Omaha policy we liked. You can apply even if you have had cancer in the past if you have been cancer-free for five years or havent had skin cancer in three years. The company also limits rate changes so if everyone with the policy experiences a rate increase, you wont experience an individual rate increase. In addition to helping offset costs if a doctor diagnosed you with cancer, the policy also provides $60 on a yearly basis for preventive screening, tests, or vaccines. Examples include a Pap smear, HPV vaccine, or mammogram. In this way, the policy pays you even if youre never diagnosed with cancer.;

Also Check: Can Merkel Cell Carcinoma Be Cured